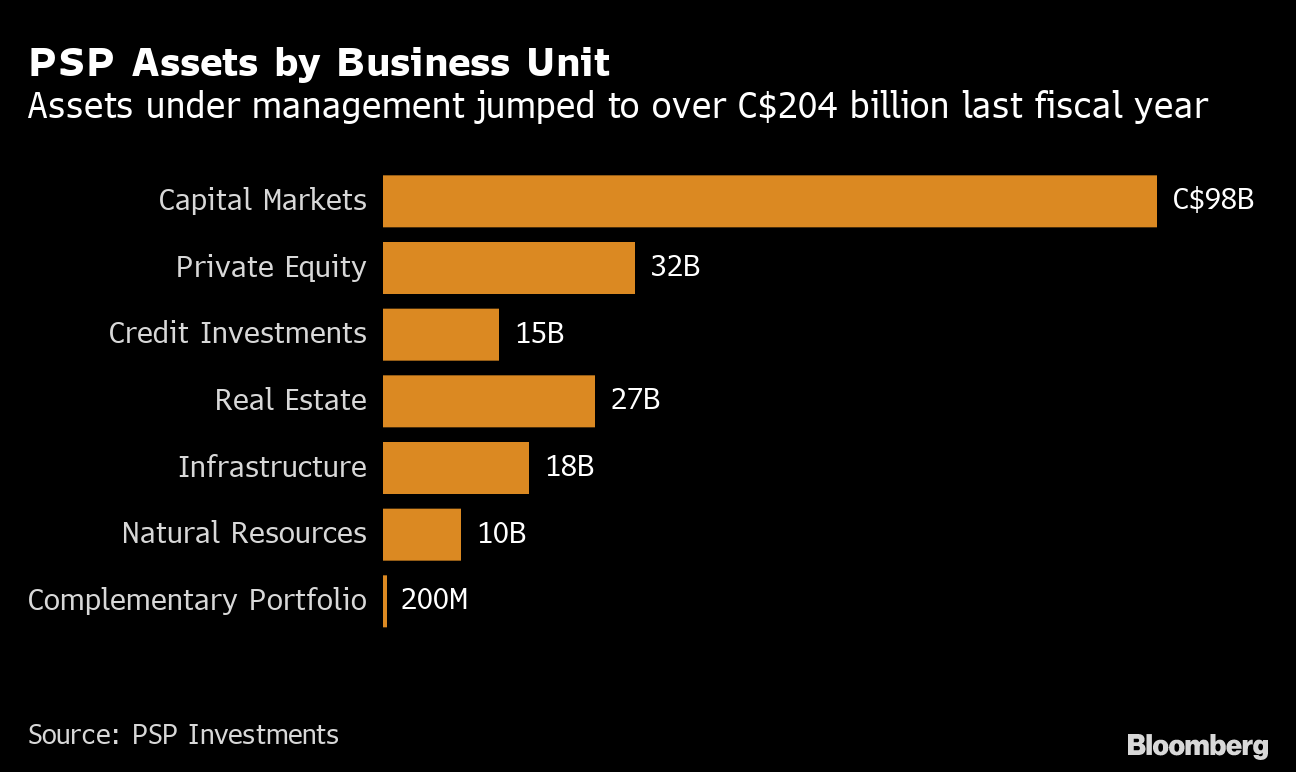

PSP Investments Posts 18.4% Return in Fiscal Year 2021 and Surpasses $200 Billion in Assets Under Management - News hub | PSP Investments

Joanne Toth Flynn Launches New Book, Accelerating Business Success: The Human Asset Management Strategy

Top Canadian funds like Brookfield Asset Management, CDPQ and PSP Investments drawn to India's highway projects - The Economic Times

CEOs of Leading Canadian Pension Plan Investment Managers support Inaugural International Sustainability Standards Board (ISSB) Standards | CPP Investments

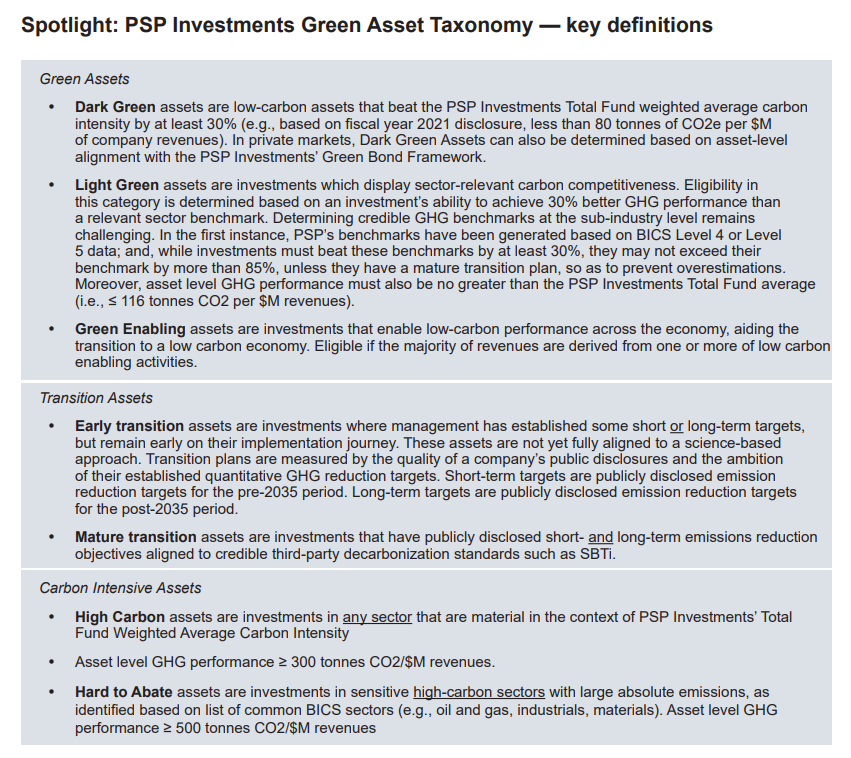

Technical Analysis of PSP Investments' 2022 Responsible Investing Report — Shift - Protect Your Pension and the Planet

PSP Investments posts strong performance in fiscal year 2018 - Net return of 9.8% brings net assets to $153.0 billion

PSP Investments Makes Significant Investment in Learning Care Group in Partnership with American Securities | Learning Care Group

CEOS OF LEADING CANADIAN PENSION PLAN INVESTMENT MANAGERS SUPPORT INAUGURAL INTERNATIONAL SUSTAINABILITY STANDARDS BOARD (ISSB) STANDARDS